In compliance with the Local Government Pension Scheme (Management and Investment of Funds) Regulations 2016, the West Midlands Pension Fund has outlined its approach to investment pooling in its Investment Strategy Statement. Working collectively with Partner Funds, the West Midlands Pension Fund created and owns LGPS Central Limited, an FCA-regulated company responsible for product development and collective investment vehicles to meet the investment requirements of the eight administering authorities as its clients.

LGPS Central Investment Pool was established in 2017 in response to the Government requirements for LGPS funds to pool investments with the aim of achieving four key objectives:

- Achieving benefits of scale

- Strong governance and decision making

- Reduced costs and excellent value for money

- Improved capacity and capability to invest in infrastructure

To support the delivery of these objectives, WMPF in collaboration with seven Partner Funds created a separate FCA-regulated entity, LGPS Central Limited to be the vehicle through which assets could be pooled and products and services developed to support funds in implementing their individual investment strategies.

As at 31 March 2022 the pool Company had launched 13 investment funds under the Authorised Contractual Scheme (ACS) and limited partnerships across three private markets, with £19.2 billion (35%) of Partner Funds assets invested. The Company has developed a framework for Responsible Investment Integrated Status and this is applied across all products. During 2021/22 the Company launched investment funds covering multi-asset credit, infrastructure and private debt providing increased opportunity for Partner Funds to invest. Responsible investment is integrated across all investment mandates and the Company confirmed its own commitment to net zero in January 2022.

Governance Framework

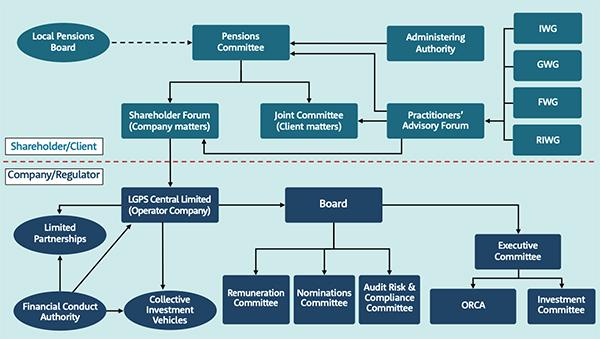

The Governance structure for the investment pool is set out in the diagram below:

In meeting the Government requirement to pool assets, and as persons charged with the responsibility for their LGPS Funds, in the context of LGPS Investment Pooling each Partner Fund wears three hats of responsibility.

- Statutory responsibility to ensure the legal obligations on LGPS Funds are met, this includes the obligation to provide for the pooling of investments in their Investment Strategy Statement. This is owned by the individual funds’ own Pension Committees.

- Owner/Shareholder (one Fund, one vote) of the investment pooling company, LGPS Central Limited who oversee the development and delivery of the Company’s objectives through formal AGM and Company meetings. Individual authorities’ own scheme of delegation determines their appointed Shareholder representative with these being both Elected Councillor and Officer.

- Client/Customer of the investment pooling company contracted under individual Client Services Agreements to deliver and manage the pooled investment products. The funds sit as a collective customer at the LGPS Central Joint Committee which provides collective oversight of the performance and direction the LGPS Central investment pool.

In order to perform functions of oversight over LGPS Central Limited (as a linked body of the administering authority) and to meet FCA requirements for a regulated asset manager, the Partner Funds stand at arms-length to the company and its ongoing management of the investment transferred to the pool. The Company Directors, (three executive and four/five non-executive) Board and Board sub committees are responsible for the day-to-day running of the Company including compliance with regulatory requirements of the FCA.

For more information, please visit the LGPS Central website.