What happens if I rejoin the LGPS?

These information pages have been provided to give you the information you need to understand about what happens to your LGPS benefits, and the choices available to you, if:

a) you have left one employment and rejoined the LGPS in another employment; or

b) you have had more than one job in which you are a member of the LGPS and have left one of those employments whilst continuing the other.

There are different scenarios that may apply depending on previous service and other factors. Our correspondence will advise you of the information from this section of the website that you should review and you should choose the relevant scenario below.

The Re-joiner Glossary is provided to help explain further some terms used in the information and gives more detail about how your benefits are calculated in the LGPS, when they become payable and other important information about protections and paying extra contributions in the LGPS.

This scenario applies when you have left an employment after 31 March 2014 with an entitlement to a deferred refund which is based on post 31 March 2014 membership (or on membership which is treated as post 31 March 2014 membership) only and you have now re-joined the LGPS.

You have re-joined the Local Government Pension Scheme (LGPS) and we note you already have a deferred refund account in the Scheme.

As you have now re-joined the LGPS you are no longer eligible to take a refund of the contributions in your deferred refund account and so the amount of pension in your deferred refund account will automatically be transferred and added into your new active pension account.

If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will need to indicate on the election form we send you which active pension account you wish your deferred refund account to be combined with.

This scenario applies when you have left an employment after 31 March 2014 with an entitlement to a deferred benefit in the LGPS which is based on post 31 March 2014 membership (or on membership which is treated as post 31 March 2014 membership) only, and who have rejoined the Local Government Pension Scheme (LGPS).

You have re-joined the LGPS and we note that you have previous deferred benefits in the LGPS.

If you were awarded those deferred benefits as a result of choosing, on or after 11 April 2015, to opt out of membership of the Scheme, those benefits will remain deferred in the Scheme and you cannot add them to the benefits you are accruing in the Scheme in your current job.

If, however, you were awarded those deferred benefits as a result of ceasing employment, or as a result of choosing, before 11 April 2015, to opt out of membership of the Scheme, you have a decision to make about what should happen to those deferred benefits and this is explained below.

Decision Required

Unless you tell us otherwise, the amount of pension in your deferred pension account will automatically be transferred and added into your new active pension account.

However, you can elect to keep you deferred benefit separate and, if you wish to do so, this must be done within 12 months of re-joining the scheme and while you are still paying into the scheme.

If you make an election to keep your benefits separate you cannot change your decision. If you do not make a decision within 12 months of re-joining the scheme your deferred benefit will automatically be combined with your new active pension account.

Please note that your employer can extend the 12 month window within which you can elect to keep your benefits separate. However, this is an employer discretion and you would need to speak to your current employer if you wish to seek such an extension.

What do I need to consider before making my decision?

At the moment, you have a separate deferred benefit for your previous employment in the LGPS. If you take no action this will be automatically transferred into your new active pension account.

You need to think about the following things when considering whether or not you should keep your benefits separate:

- How will the benefits from my previous employment be worked out?

- When will my benefits be payable?

- Are there other key areas to consider?

How will the benefits from my previous employment be worked out?

Your benefits from your previous employment will be worked out in the same way if they are combined or if they are kept separate.

If you have re-joined the LGPS having had a continuous break in active membership of a public service pension scheme of less than 5 years your deferred pension account will be recalculated by the HM Treasury Revaluation Orders.

If you have re-joined the LGPS having had a continuous break in active membership of a public service pension scheme of more than 5 years your deferred pension account will be revalued by Pension Increase (Review) Orders.

When will my benefits be payable?

The Normal Pension Age applicable to your benefits in the scheme is the same regardless of whether or not you combine your benefits or keep them separate. Your Normal Pension Age is linked to your State Pension Age.

|

What key differences are there if I elected to keep my deferred benefits separate? |

||

|

|

Combined Benefits |

Separate Benefits |

|

Redundancy/ Business Efficiency |

Benefits paid early because of redundancy or efficiency would include the value of earlier deferred benefits that have been transferred. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately and would include the value of the pension that transferred from your deferred benefit. |

Benefits paid early because of redundancy or efficiency in your new employment would not include the value of earlier deferred benefits. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately but would not include the value of your deferred benefit (because you had elected to retain that as a separate deferred benefit). Subject to the information in the boxes below, the separate deferred benefits would be payable at your Normal Pension Age. |

|

Ill- health |

Any benefits paid early because of ill-health would include value of earlier deferred benefits that have transferred. Your benefits will become payable immediately if your employer decides, based on the opinion of an independent doctor that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would include the value of your pension that transferred from your deferred benefit. |

Benefits paid early because of ill-health would not include the value of earlier deferred benefits. Your benefits from your new employment will become payable immediately if your employer decides, based on the opinion of an independent doctor, that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would not include the value of your deferred benefit (because you elected to retain that as a separate deferred benefit). Your separate deferred benefit may become payable but that would only be if your former employer decided in light of the view from an independent doctor that you are permanently incapable of the job you were working in when you left their employment and that you are not likely to be capable of undertaking other gainful employment before your Normal Pension Age or for at least three years, whichever is the sooner. |

|

Early payment of benefits |

You can voluntarily choose to draw the combined benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment). However, the combined benefits would be payable at the same time (i.e. cannot be paid at different times) and cannot be paid until you have ceased your new employment.

|

You can voluntarily choose to draw benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment). However, the deferred benefits do not have to be drawn at the same time as the benefits from your new employment. The deferred benefits can be drawn later than, at the same time as, or earlier than the benefits from your new employment (even if you are still in your new employment at the time you wish to draw the deferred benefits). |

|

Cost of living increases |

The combined benefits will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see the Re-joiner Glossary page for more information). However, in the times of negative inflation, the revaluation order under a HM Treasury Order could be negative. |

The benefits in the active pension account will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see the Re-joiner Glossary page for more information)). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. The benefits in the deferred pension account will be subject to revaluation each year under the Pensions (Increase) Act 1971. Future revaluation is currently in line with the rise in the Consumer Prices Index. In times of negative inflation, the revaluation under the Pensions (Increase) Act 1971 would be 0% (i.e. it cannot be a negative amount). |

Are there any other key areas to consider?

Death in Service lump sum

As a member of the LGPS if you die in service a lump sum of three times your annual pensionable pay would normally be payable. If you have a deferred pension, and die before it is paid, a lump sum equal to 5 times the deferred pension is paid. However, only one amount for lump sum life cover is payable from the LGPS so, even if you keep your deferred benefits separate from your active pension account, only the greater of the lump sum life cover for your deferred benefit or for your active pension account would be payable.

Paying extra contributions

Have you paid extra contributions towards buying additional pension? This would include Additional Voluntary Contributions (AVCs) and Additional Pension Contributions (APCs). Please read the information paying extra contributions in the Re-joiner Glossary page to find out what your choices in respect of these are.

Transferring the value of your deferred benefit to another pension scheme

Please note that even if you choose not to combine your benefits you will not be able to transfer the value of your deferred benefits to another pension scheme whilst you are contributing to the LGPS or if you have less than one year to go before reaching your Normal Pension Age.

What next?

Please complete the attached option form to tell us whether or not you wish to combine your benefits**. This will enable us to take the appropriate action in respect of your pension rights as quickly as possible. If we do not receive your completed form within 12 months of the date you re-joined the scheme, your previous deferred benefit will automatically be transferred to your new active pension account at the end of the 12 month period.

**Please note that if you have more than one ongoing employment in which you are continuing to contribute to the LGPS, please indicate which active pension account you wish your deferred benefit to be combined with.

This scenario applies when you have left employment after 31 March 2014 with an entitlement to a deferred refund in the LGPS, and you were in the scheme on both 31 March and 1 April 2014, and re-joined the LGPS again without having a continuous break in active membership of a public service pension scheme of more than five years since ceasing to be an active member of the LGPS in the employment to which the deferred refund relates.

You have re-joined the Local Government Pension Scheme (LGPS) and we note you have a deferred refund account in the Scheme.

As you have now re-joined the LGPS you are no longer eligible to take a refund of the contributions in your deferred refund account and so the amount of pension you have built up after 31 March 2014 in your deferred refund account will automatically be transferred and added into your new active pension account.

If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will need to indicate on the election form we send you which active pension account you wish your deferred refund account to be combined with.

The membership you built up before 1 April 2014 in the final salary scheme will continue to count as final salary membership* and will automatically be linked to your new active pension account.

When you leave your new employment in the future your final pay in that employment will be used to work out your final salary benefits for your pre 1 April 2014 membership. You will also have pension benefits for all the membership you have built up in the career average scheme (i.e. for membership after 31 March 2014). See Working out your benefits in the LGPS in the Re-joiner Glossary page for information on how these benefits are calculated.

For the pension you have built up in the final salary scheme (before 1 April 2014) your Normal Pension Age would be protected at age 65. For the pension you have built up in the career average scheme (on or after 1 April 2014) your Normal Pension Age is now linked to your State Pension Age (minimum age 65).

If you have rule of 85 protections these protections will continue to apply to you. See the Re-joiner Glossary page for more information on the rule of 85.

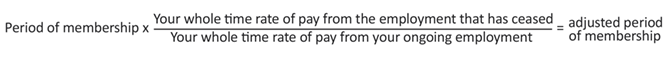

*If your membership in the final salary scheme built-up before 1 April 2014 was variable time and your new employment is not variable time then, to ensure you get the appropriate level of membership for that period, your pre 1 April 2014 membership from the former employment is adjusted, using the following formula:

Period of membership x Your annual rate of pay in the variable time employment / Your annual rate of pay in the new employment = adjusted period of membership.

This scenario applies when you left an employment after 31 March 2014 with an entitlement to a deferred benefit in the LGPS, were in the scheme on both the 31 March and 1 April 2014, and re-joined the LGPS again without having had a continuous break in active membership of a public service pension scheme of more than five years since ceasing to be an active member of the LGPS in the employment to which the deferred benefit relates.

You have re-joined the Local Government Pension Scheme (LGPS) and we note that you have previous deferred benefits in the LGPS. You therefore have a decision to make about what should happen to those deferred benefits.

Unless you tell us otherwise, the amount of pension you have built up after 31 March 2014 in your deferred pension account will automatically be transferred and added to your new active pension account and the membership you built up before 1 April 2014 in the final salary scheme will continue to count as final salary membership automatically linked to your new active pension account.

Decision Required

You can elect to keep you deferred benefits separate and, if you wish to do so, this must be done within 12 months of re-joining the scheme and while you are still paying into the scheme.

If you make an election to keep your benefits separate you cannot change your decision. If you do not make a decision within the 12 month period of re-joining the scheme then your deferred benefit will automatically be combined with your new active pension account.

Please note that your employer can extend the 12 month window within which you can elect to keep your benefits separate. However, this is an employer discretion and you would need to speak to your current employer if you wish to seek such an extension.

What do I need to consider before making my decision?

At the moment you have a separate deferred benefit for your previous employment in the LGPS. If you take no action this will be automatically combined with your new active pension account.

You need to think about the following things when considering whether or not you should keep your benefits separate:

- How will the benefits from my previous employment be worked out?

- When will my benefits be payable?

- Are there other key areas to consider?

How will the benefits from my previous employment be worked out?

You have built up benefits in the both the final salary scheme (up to 31 March 2014) and the career average scheme (from 1 April 2014). See Working out your benefits in the LGPS in the Re-joiner Glossary page for information on how these benefits are calculated.

If your previous deferred benefit is combined with your new active pension account then:

-

the membership you built up before 1 April 2014 in the final salary scheme will continue to count as final salary membership*. This membership will be linked to your active pension account and when you leave your new employment in the future your final pay in that employment will be used to work out your final salary benefits for your pre 1 April 2014 membership;

-

the amount of pension you have built up in the career average scheme from 1 April 2014 would transfer over to your new active pension account.

If you elect to keep separate deferred benefits then these will increase each year in line with inflation, as currently measured by the rise in the Consumer Prices Index (see the Re-joiner Glossary page page for more information).

* If your membership in the final salary scheme built-up before 1 April 2014 was variable time and your ongoing employment is not variable time then, to ensure you get the appropriate level of membership for that period, your pre 1 April 2014 membership from the employment that has ceased is adjusted, using the following formula:

Period of membership x Your annual rate of pay in the variable time employment / Your annual rate of pay in the ongoing employment = adjusted period of membership.

When will my benefits be payable?

For the pension you have built up in the final salary scheme (before 1 April 2014) your Normal Pension Age would be protected at age 65. For the pension you have built up in the career average scheme (on or after 1 April 2014) your Normal Pension Age is now linked to your State Pension Age. For more information on Normal Pension Age see the Re-joiner Glossary page.

|

What key differences are there if I elected to keep my deferred benefits separate? |

||

|

|

Combined Benefits |

Separate Benefits |

|

Redundancy/ Business Efficiency |

Benefits paid early because of redundancy or efficiency would include the value of earlier deferred benefits that have been transferred. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately and would include the value of the pension that transferred from your deferred benefit. |

Benefits paid early because of redundancy or efficiency in your new employment would not include the value of earlier deferred benefits. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately but would not include the value of your deferred benefit (because you had elected to retain that as a separate deferred benefit). Subject to the information in the boxes below, the separate deferred benefits would be payable at your Normal Pension Age. |

|

Ill- health |

Any benefits paid early because of ill-health would include value of earlier deferred benefits that have transferred. Your benefits will become payable immediately if your employer decides, based on the opinion of an independent doctor that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would include the value of your pension that transferred from your deferred benefit. |

Benefits paid early because of ill-health would not include the value of earlier deferred benefits. Your benefits from your new employment will become payable immediately if your employer decides, based on the opinion of an independent doctor, that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would not include the value of your deferred benefit (because you elected to retain that as a separate deferred benefit). Your separate deferred benefit may become payable but that would only be if your former employer decided in light of the view from an independent doctor that you are permanently incapable of the job you were working in when you left the employment in respect of which the deferred benefit was awarded. |

|

Early payment of benefits |

You can voluntarily choose to draw the combined benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment). However, the combined benefits would be payable at the same time (i.e. cannot be paid at different times) and cannot be paid until you have ceased your new employment.

|

You can voluntarily choose to draw benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment). However, the deferred benefits do not have to be drawn at the same time as the benefits from your new employment. The deferred benefits can be drawn later than, at the same time as, or earlier than the benefits from your new employment (even if you are still in your new employment at the time you wish to draw the deferred benefits). |

|

Rule of 85 (for more info on this please see the Re-joiner Glossary page)

|

If your previous benefits are combined with your new employment and you have rule of 85 protections these protections will transfer to your new active pension account. However, the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85. |

If you decide not to combine your previous benefits with your new active pension account and you have rule of 85 protections then these continue to apply to your deferred benefits only. |

|

Pay upon which pre 1 April 2014 benefits are calculated |

If your previous benefits are combined with your new employment the pre 1 April 2014 element of your benefits will continue to be final salary benefits. They will be calculated using your whole-time equivalent final pay in the new employment when you cease membership of the LGPS in that employment (based on the definition of final pay in the final salary scheme). You will need to consider this point carefully if your whole-time equivalent pay in the new employment is less than the whole-time equivalent pay on which your deferred benefit was awarded (as increased in line with the cost of living). |

If you decide not to combine your previous benefits with your new active pension account, the pre 1 April 2014 element of your deferred benefit will have been calculated on your whole-time equivalent final pay in the employment that gave rise to the deferred benefits (based on the definition of final pay in the final salary scheme). |

|

Cost of living increases |

The combined benefits will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. |

The benefits in the active pension account will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index. However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. The benefits in the deferred pension account will be subject to revaluation each year under the Pensions (Increase) Act 1971. Future revaluation is currently in line with the rise in the Consumer Prices Index. In times of negative inflation, the revaluation under the Pensions (Increase) Act 1971 would be 0% (i.e. it cannot be a negative amount). |

Are there any other key areas to consider?

Death in Service lump sum

As a member of the LGPS if you die in service a lump sum of three times your annual pensionable pay would normally be payable. If you have a deferred pension and die before it is paid, a lump sum equal to five times the deferred pension is paid. However, only one amount for lump sum life cover is payable from the LGPS so, even if you keep your deferred benefits separate from your active pension account, only the greater of the lump sum life cover for your deferred benefit or for your active pension account would be payable.

Annual Allowance Potential Tax Implications

You are advised to be aware of any potential tax implications around combining your deferred benefits with your new active pension account. In the unlikely event that a tax charge would apply your Pension Fund would make you aware of the implications. Please read the Re-joiner Glossary page for more information on annual allowance.

Paying extra contributions

Have you paid extra contributions towards buying additional pension or membership? These would include Additional Voluntary Contributions (AVCs), Added Years, Additional Regular Contributions (ARCs) or Additional Pension Contributions (APCs). Please read the Re-joiner Glossary page and the entry on paying extra contributions to find out what your choices in respect of these are.

What next?

We would have sent you an option form. Please complete this form to tell us whether or not you wish to combine your benefits**. This will enable us to take the appropriate action in respect of your pension rights as quickly as possible.

If we do not receive your completed form within 12 months of the date you re-joined the scheme, your previous deferred benefit will automatically be transferred to your new active pension account at the end of the 12 month period.

**If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will also, if you decide to combine your benefits, need to decide which active pension account you wish your deferred benefit to be combined with.

This scenario applies when you left an employment after 31 March 2014 with an entitlement to a deferred benefit in the LGPS, were in the scheme on both the 31 March and 1 April 2014 and who re-joined the LGPS again having had a continuous break in active member of a public service pension scheme of more than 5 years since ceasing to be an active member of the LGPS in the employment to which the deferred benefit relates.

You have re-joined the Local Government Pension Scheme (LGPS). We note that you have previous deferred benefits in the LGPS.

If you were awarded those deferred benefits as a result of choosing, on or after 11 April 2015, to opt out of membership of the Scheme, those benefits will remain deferred in the Scheme and you cannot add them to the benefits you are accruing in the Scheme in your current job.

If, however, you were awarded those deferred benefits as a result of ceasing employment, or as a result of choosing, before 11 April 2015, to opt out of membership of the Scheme, you have a decision to make about what should happen to those deferred benefits and this is explained below.

Decision Required

Unless you tell us otherwise, your deferred benefit will automatically be combined with your new active pension account.

You can elect to keep you deferred benefits separate and, if you wish to do so, this must be done within 12 months of re-joining the scheme and while you are still paying into the scheme.

If you make an election to keep your benefits separate you cannot change your decision. If you do not make a decision within the 12 month period of re-joining the scheme then your deferred benefit will automatically be combined with your new active pension account.

Please note that your employer can extend the 12 month window within which you can elect to keep your benefits separate. However, this is an employer discretion and you would need to speak to your current employer if you wish to seek such an extension.

What do I need to consider before making my decision?

At the moment you have separate deferred benefits for your previous employment in the LGPS. If you take no action these will be automatically combined with your new pension account.

You need to think about the following things when considering whether or not you should keep your benefits separate:

- How will the benefits from my previous employment be worked out?

- When will my benefits be payable?

- Are there other key areas to consider?

How will the benefits from my previous employment be worked out?

You have built up benefits in the both the final salary scheme (up to 31 March 2014) and the career average scheme (from 1 April 2014). See Working out your benefits in the LGPS the glossary for information on how these benefits are calculated.

If your previous deferred benefit is combined with your new active pension account then:

- the membership you built up before 1 April 2014 in the final salary scheme will no longer count as final salary membership. Instead the value of benefits built up before 1 April 2014 in the final salary scheme will buy an amount of earned pension in the career average scheme which will be added into your new active pension account.

- the amount of pension you have built up in the career average scheme from 1 April 2014 would transfer over to your new active pension account.

If you elect to retain separate benefits then your deferred benefit will remain as previously worked out i.e.:

- that part of your deferred benefit which was based on your pre 1 April 2014 final salary membership of the LGPS will have been worked out on your whole-time equivalent final pay in the employment that gave rise to the deferred benefit, and

- you will have an amount of pension built up in the career average scheme after 1 April 2014 and the date you left the LGPS in the employment that gave rise to the deferred benefit.

If you elect to keep separate deferred benefits then your deferred benefits will increase each year in line with inflation, as currently measured by the rise in the Consumer Prices Index (see the glossary for more information).

When will my benefits be payable?

If your previous deferred benefit is combined with your new active pension account then all your combined benefits will be payable at the Normal Pension Age for the scheme from 1 April 2014. Therefore, your Normal Pension Age would be the same as your State Pension Age (minimum age 65). For more information on Normal Pension Age see the glossary.

Rule of 85 protections will continue for some members in relation to some of their membership, see the information below on rule of 85 protections.

If you elect to keep your deferred benefits separate then the date these are payable would remain the same with your Normal Pension Age being age 65 for benefits built up to 31 March 2014 and for benefits built up from 1 April 2014 your Normal Pension Age is linked to your State Pension Age (minimum age 65). For more information on Normal Pension Age see the glossary.

Rule of 85

If your previous benefits are combined with your new employment, the value of those benefits buys an amount of earned pension in the career average scheme and any rule of 85 protection you previously had will be reflected in the amount of earned pension bought. Therefore, to reflect the fact that those earlier benefits would now be payable unreduced at your Normal Pension Age under the career average scheme (i.e. the same as your State Pension Age, with a minimum age of 65) the amount of earned pension bought by the transferred benefits would be higher because you previously had rule of 85 protection. In addition, if your previous benefits are combined with your new employment, there are further protections for rule of 85 if you are close to retirement including.

-

If you will be age 60 or over by 31 March 2016 and re-join the scheme before 1 April 2016 then the rule of 85 will continue to apply to the membership you build up between re-joining the scheme and 31 March 2016 (although the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85). However, the rule of 85 will not continue to apply to the amount of earned pension bought when you combined your deferred pension (but the amount of earned pension bought will include an amount to compensate for the loss of rule of 85 protection on that pension).

-

If you will be age 60 between 1 April 2016 and 31 March 2020 and re-join the scheme before 1 April 2020 then the rule of 85 will continue to apply to the membership you build up between re-joining the scheme and 31 March 2020 (although the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85). However, therule of 85 will not continue to apply to the amount of earned pension bought when you combined your deferred pension (but the amount of earned pension bought will include an amount to compensate for the loss of rule of 85 protection on that pension).

If you decide not to combine your previous deferred benefits with your new active pension account and you have rule of 85 protections then these would continue to apply, but to your deferred benefits only.

|

What key differences are there if I elected to keep my deferred benefits separate? |

||

|

|

Combined Benefits |

Separate Benefits |

|

Redundancy/ Business Efficiency |

Benefits paid early because of redundancy or efficiency would include the value of earlier deferred benefits that have been transferred.

If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately and would include the value of the pension that transferred from your deferred benefit. |

Benefits paid early because of redundancy or efficiency in your new employment would not include the value of earlier deferred benefits.

If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately but would not include the value of your deferred benefit (because you had elected to retain that as a separate deferred benefit).

Subject to the information in the boxes below, the separate deferred benefits would be payable at your Normal Pension Age. |

|

Ill- health |

Any benefits paid early because of ill-health would include value of earlier deferred benefits that have transferred.

Your benefits will become payable immediately if your employer decides, based on the opinion of an independent doctor that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would include the value of your pension that transferred from your deferred benefit. |

Benefits paid early because of ill-health would not include the value of earlier deferred benefits.

Your benefits from your new employment will become payable immediately if your employer decides, based on the opinion of an independent doctor, that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would not include the value of your deferred benefit (because you elected to retain that as a separate deferred benefit).

Your separate deferred benefit may become payable but that would only be if your former employer decided in light of the view from an independent doctor that you are permanently incapable of the job you were working in when you left the employment in respect of which the deferred benefit was awarded and that you are not likely to be capable of undertaking other gainful employment before your Normal Pension Age or for at least 3 years, whichever is the sooner.

|

|

Early payment of benefits |

You can voluntarily choose to draw the combined benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment).

However, the combined benefits would be payable at the same time (i.e. cannot be paid at different times) and cannot be paid until you have ceased your new employment.

|

You can voluntarily choose to draw benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment).

However, the deferred benefits do not have to be drawn at the same time as the benefits from your new employment. The deferred benefits can be drawn later than, at the same time as or, subject to being at least age 55, earlier than the benefits from your new employment (even if you are still in your new employment at the time you wish to draw the deferred benefits). |

|

Cost of living increases |

The combined benefits will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. |

The benefits in the active pension account will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative.

The benefits in the deferred pension account will be subject to revaluation each year under the Pensions (Increase) Act 1971. Future revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). In times of negative inflation, the revaluation under the Pensions (Increase) Act 1971 would be 0% (i.e. it cannot be a negative amount). |

Death in Service lump sum

As a member of the LGPS if you die in service a lump sum of three times your annual pensionable pay would normally be payable. If you have a deferred pension and die before it is paid, a lump sum equal to 5 times the deferred pension is paid. However, only one amount for lump sum life cover is payable from the LGPS so, even if you keep your deferred benefits separate from your active pension account only the greater of the lump sum life cover for your deferred benefit or for your active pension account would be payable.

Annual Allowance Potential Tax Implications

You are advised to be aware of any potential tax implications around combining your deferred benefits with your new active pension account. In the unlikely event that a tax charge would apply your Pension Fund would make you aware of the implications. Please read the glossary for more information on annual allowance.

Paying extra contributions

Have you paid extra contributions towards buying additional pension or membership? These would include Additional Voluntary Contributions (AVCs), Added Years, Additional Regular Contributions (ARCs) or Additional Pension Contributions (APCs). Please read paying extra contributions in the glossary to find out what your choices in respect of these are.

Transferring the value of your deferred benefit to another pension scheme

Please note that even if you choose not to combine your benefits you will not be able to transfer the value of your deferred benefits to another pension scheme whilst you are contributing to the LGPS or if you have less than one year to go before reaching your Normal Pension Age.

What next?

We would have sent you an option form. Please complete this form to tell us whether or not you wish to combine your benefits**. This will enable us to take the appropriate action in respect of your pension rights as quickly as possible.

If we do not receive your completed form within 12 months of the date you re-joined the scheme, your previous deferred benefit will automatically be transferred to your new active pension account at the end of the 12-month period.

**If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will also, if you decide to combine your benefits, need to decide which active pension account you wish your deferred benefit to be combined with.

This scenario applies when you left an employment before 1 April 2014 with an entitlement to a deferred refund in the LGPS, and re-joined the LGPS.

As you have now re-joined the LGPS you are no longer eligible to take the refund of contributions and so the benefits in respect of the deferred refund will automatically be transferred to, and buy a amount of earned pension, in your new active pension account.

If you have more than one active pension action (because you have more than one current employment in which you are contributing to the LGPS) you will need to decide which active pension account you wish the benefits from your deferred refund to be combined with.

The Normal Pension Age for the earned pension transferred over to your new active pension account will be the same as your State Pension Age. See the Re-joiner Glossary page for more information about Normal Pension Age.

This scenario applies when you left an employment before 1 April 2014 with an entitlement to a deferred benefit in the LGPS, and re-joined the LGPS without having a continuous break in active membership of a public service pension scheme of more than five years since ceasing to be an active member of the LGPS in the employment to which the deferred benefit relates.

You have three options available to you and you need to consider which one you wish to elect for.

What do I need to consider before making my decision?

At the moment you have a separate deferred benefit for your previous employment in the LGPS. If you take no action then your deferred benefit will remain separate from your new active pension account.

You need to think about the following things when considering whether or not you should keep your benefits separate:

- How will the benefit from my previous employment be worked out?

- When will my benefit be payable?

- Are there other key areas to consider?

Option One:

You can elect to combine your pre 1 April 2014 final salary membership with your new active pension account so that it continues to count as final salary scheme membership.

To do this you need to elect within 12 months of re-joining the scheme to be treated as if you were an active member of the scheme on both the 31 March and 1 April 2014. If you make this election your pre 1 April 2014 membership will be attached to your new pension account and the benefits in respect of that membership will continue to count as a final salary membership. This means that, when you cease membership of the LGPS at some point in the future in your new employment, the benefits in respect of your pre 1 April 2014 membership would be calculated using your whole-time equivalent final pay in that employment (based on the definition of final pay in the final salary scheme).

You will need to consider this point carefully when deciding whether or not to elect for option one, particularly if your whole-time equivalent pay in the new employment is less than the whole-time equivalent final pay on which your deferred benefit was awarded (as increased in line with the cost of living).

If you decide not to combine your previous benefits with your new active pension account, your deferred benefit (which will have been calculated on your whole-time equivalent final pay in the employment that gave rise to the deferred benefits) will continue to be increased in line with inflation.

There are, also other matters that you will need to consider including:

When will my benefits be payable?

If you choose option one then the date your pre 1 April 2014 benefits are payable from would be age 65 i.e. your Normal Pension Age for those benefits would be age 65. For the benefits you build up in the career average scheme (after 31 March 2014) your Normal Pension Age is linked to your State Pension Age (with a minimum age 65). If your deferred benefits are combined with your new active pension account and any final salary benefits you have previously built up continue to be counted as final salary benefits then they will continue to have a Normal Pension Age of 65.

For more information on Normal Pension Agee see the Re-joiner Glossary.

Rule of 85

If your previous benefits are combined with your new employment and you have rule of 85 protections these protections will transfer to your new active pension account. However, the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85.

If you decide not to combine your previous benefits with your new active pension account and you have rule of 85 protections then these continue to apply to your deferred benefits only.

For more information on the rule of 85 see the Re-joiner Glossary.

Please note: If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will need to decide which active pension account you wish the benefits from your deferred refund to be combined with.

If your membership in the final salary scheme was variable time and your ongoing employment is not variable time then, to ensure you get the appropriate level of membership for that period, your pre 1 April 2014 membership that has ceased will be adjusted using the following formula:

Period of membership x your annual rate of pay in the variable time employment / your annual rate of pay in the ongoing employment = adjusted period of membership.

If you choose option 1 then you must make that election within 12 months of rejoining the scheme and whilst you are still paying into the scheme.

Option Two

You can elect to combine your deferred benefit with your new pension account to buy an amount of earned pension in the career average scheme which will buy an amount of earned pension in the career average scheme which will be added into your new active pension account.

If you choose option two your previous deferred benefit will be combined with your new active pension account and the membership you built up before 1 April 2014 in the final salary scheme will no longer count as final salary membership. Instead the value of benefits built up before 1 April 2014 in the final salary scheme will buy an amount of earned pension in the career average scheme which will be added into your new active pension account.

When will my benefits be payable?

If you choose option two then your combined benefits will be payable at your Normal Pension Age under the career average scheme which will be the same as your State Pension Age (with a minimum age 65). For more information on Normal Pension Age see the Re-joiner Glossary.

Rule of 85

If you choose option two, any rule of 85 protection you previously had will be reflected in the amount of earned pension bought. Therefore, to reflect the fact that those earlier benefits would now be payable unreduced at your Normal Pension Age under the career average scheme (i.e. the same as your State Pension Age, with a minimum age of 65) the amount of earned pension bought by the transferred benefits would be higher because you previously had rule of 85 protection.

In addition, if your previous benefits are combined with your new employment under option two, there are further protections for rule of 85 if you are close to retirement including:

-

If you will be age 60 or over by 31 March 2016 and re-join the scheme before 1 April 2016 then the rule of 85 will continue to apply to the membership you build up between re-joining the scheme and 31 March 2016 (although the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85). However, therule of 85 will not continue to apply to the amount of earned pension bought when you combined your deferred pension (but the amount of earned pension bought will include an amount to compensate for the loss of rule of 85 protection on that pension).

-

If you will be age 60 between 1 April 2016 and 31 March 2020 and re-join the scheme before 1 April 2020 then the rule of 85 will continue to apply to the membership you build up between re-joining the scheme and 31 March 2020 (although the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85). However, therule of 85 will not continue to apply to the amount of earned pension bought when you combined your deferred pension (but the amount of earned pension bought will include an amount to compensate for the loss of rule of 85 protection on that pension).

If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will need to decide which active pension account you wish the benefits from your deferred refund to be combined with.

If your membership in the final salary scheme was variable time and your ongoing employment is not variable time then, to ensure you get the appropriate level of membership for that period, your pre 1 April 2014 membership that has ceased will be adjusted using the following formula:

Period of membership x your annual rate of pay in the variable time employment / your annual rate of pay in the ongoing employment = adjusted period of membership.

Option Three

You can elect to keep your deferred benefit separate from your new active pension account.

If you decide not to combine your deferred benefits or you do not make an election within 12 months of re-joining the scheme then your deferred benefits will remain separate.

How will the benefits from my previous employment be worked out?

If you choose option three your deferred benefit will remain as previously calculated and held with your previous Pension Fund (if not the West Midlands Pension Fund). See Working out your benefits in the LGPS the Re-joiner Glossary for information on how these benefits are calculated.

The deferred benefit will increase each year in line with inflation, as currently measured by the rise in the Consumer Prices Index.

When will my deferred benefits be payable?

The date your deferred benefits are payable would remain the same, with your Normal Pension Age being age 65 if the deferred benefits relate to a period of membership that ended after 30 September 2006, or a date somewhere between 60 and 65 if the deferred benefits relate to a period of membership that ended before 1 October 2006. For more information on Normal Pension Age see the Re-joiner Glossary.

Rule of 85

If you chose option three (i.e. decide not to combine your previous benefits with your new active pension account) and you have rule of 85 protections, then these continue to apply to your deferred benefits only.

For more information on the rule of 85 see the Re-joiner Glossary.

|

What key differences are there if I elected to keep my deferred benefits separate? |

||

|

|

Combined Benefits |

Separate Benefits |

|

Redundancy/ Business Efficiency |

Benefits paid early because of redundancy or efficiency would include the value of earlier deferred benefits that have been transferred. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately and would include the value of the pension that transferred from your deferred benefit. |

Benefits paid early because of redundancy or efficiency in your new employment would not include the value of earlier deferred benefits. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately but would not include the value of your deferred benefit (because you had elected to retain that as a separate deferred benefit). Subject to the information in the boxes below, the separate deferred benefits would be payable at your Normal Pension Age. |

|

Ill- health |

Any benefits paid early because of ill-health would include value of earlier deferred benefits that have transferred. Your benefits will become payable immediately if your employer decides, based on the opinion of an independent doctor that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would include the value of your pension that transferred from your deferred benefit. |

Benefits paid early because of ill-health would not include the value of earlier deferred benefits. Your benefits from your new employment will become payable immediately if your employer decides, based on the opinion of an independent doctor, that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would not include the value of your deferred benefit (because you elected to retain that as a separate deferred benefit). Your separate deferred benefit may become payable but that would only be if your former employer decided in light of the view from an independent doctor that you are permanently incapable of the job you were working in when you left the employment in respect of which the deferred benefit was awarded and, if the deferred benefits arose as a result of ceasing membership of the scheme after 31 March 2008, that you are not likely to be capable of undertaking other gainful employment before your Normal Pension Age or for at least 3 years, whichever is the sooner. |

|

Early payment of benefits |

You can voluntarily choose to draw the combined benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment). However, the combined benefits would be payable at the same time (i.e. cannot be paid at different times) and cannot be paid until you have ceased your new employment.

|

You can voluntarily choose to draw: a) your deferred benefit from as early as age 60 or, with your former employer's consent, from as early as age 50 if the deferred benefits arose as a result of ceasing membership of the scheme after 31 March 1998 and before 1 April 2008, or age 55 if the deferred benefits arose as a result of ceasing membership of the scheme after 31 March 2008 (at, normally, a reduced rate to account for the early payment) and b) the pension you build up in your pension account in your new employment from as early as age 55 (at, normally, a reduced rate to account for the early payment). The deferred benefits do not have to be drawn at the same time as the benefits from your new employment. The deferred benefits can be drawn later than, at the same time as or, subject to being the minimum age shown in (a) above and, where necessary, obtaining your former employer's permission, earlier than the benefits from your new employment (even if you are still in your new employment at the time you wish to draw the deferred benefits, provided the deferred benefits relate to a period of membership that ended after 31 March 1998). However, if the deferred benefits relate to a period of membership that ended before 1 April 1998, the earliest you can voluntarily draw the deferred benefits is:

(i) the date you cease such employment, or (ii) your Normal Pension Age in relation to those deferred benefits (see the Re-joiner Glossary). |

|

Cost of living increases |

If you choose option 1, the combined benefits in respect of your post 31 March 2014 membership will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see the Re-joiner Glossary for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. The benefits in respect of your pre 1 April 2014 membership will continue to be final salary benefits. They will be calculated using your whole-time equivalent final pay in the new employment when you cease membership of the LGPS in that employment (based on the definition of final pay in the final salary scheme). If you choose option two, the combined benefits in respect of both your pre 1 April 2014 and post 31 March 2014 membership will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. |

The benefits in the active pension account for your new employment will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see the Re-joiner Glossary. for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. The benefits in the deferred pension account will be subject to revaluation each year under the Pensions (Increase) Act 1971. Future revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). In times of negative inflation, the revaluation under the Pensions (Increase) Act 1971 would be 0% (i.e. it cannot be a negative amount). |

Death in Service lump sum

As a member of the LGPS if you die in service a lump sum of three times your annual pensionable pay would normally be payable. If you have a deferred pension and die before it is paid, a lump sum equal to five times the deferred pension is paid if the deferred benefits relate to a period of membership that ended after 31 March 2008, or a lump sum equal to three times the deferred pension is paid if the deferred benefits relate to a period of membership that ended before 1 April 2008. However, only one amount for lump sum life cover is payable from the LGPS so, even if you keep your deferred benefits separate from your active pension account only the greater of the lump sum life cover for your deferred benefit or for your active pension account would be payable.

Annual Allowance Potential Tax Implications

You are advised to be aware of any potential tax implications around combining your deferred benefits under option one and option two with your new active pension account. In the unlikely event that a tax charge would apply the West Midlands Pension Fund would make you aware of the implications. Please see the Re-joiner Glossary for more information on annual allowance.

Paying extra contributions

Have you paid extra contributions towards buying additional pension or membership? These would include Additional Voluntary Contributions (AVCs), Added Years or Additional Regular Contributions (ARCs). Please read paying extra contributions in the Re-joiner Glossary to find out what your choices in respect of these are.

Transferring the value of your deferred benefit to another pension scheme

Please note that even if you choose not to combine your benefits you will not be able to transfer the value of your deferred benefits to another pension scheme whilst you are contributing to the LGPS or if you have less than one year to go before reaching your Normal Pension Age.

What next?

Please complete the attached option form we've provided you to tell us whether or not you wish to combine your benefits and, if you do, whether you wish to elect for option one or option two. This will enable us to take the appropriate action in respect of your pension rights as quickly as possible. If we do not receive your completed form within 12 months of the date you re-joined the scheme, your previous deferred benefit will remain separate and/or held in your previous Pension Fund (where applicable).

Once you have chosen which option you wish to proceed with you cannot change your decision. If you do not elect for option one or option two then your deferred benefit will remain separate from your new active pension account.

This scenario applies when you left an employment before 1 April 2014 with an entitlement to a deferred benefit in the LGPS, and re-joined the LGPS having had a continuous break in active membership of a public service pension scheme of more than five years since ceasing to be an active member of the LGPS in the employment to which the deferred benefit relates.

You have two options available to you and you need to consider which one you wish to elect for.

What do I need to consider before making my decision?

At the moment you have a separate deferred benefit for your previous employment in the LGPS. If you take no action then your deferred benefit will remain separate from your new active pension account.

You need to think about the following things when considering whether or not you should keep your benefits separate:

- How will the benefit from my previous employment be worked out?

- When will my benefit be payable?

- Are there other key areas to consider?

Option One

You can elect to combine your deferred benefit with your new pension account to buy an amount of earned pension in the career average scheme which will be added into your new active pension account.

If you choose this option your previous deferred benefit will be combined with your new active pension account and the membership you built up before 1 April 2014 in the final salary scheme will no longer count as final salary membership. Instead the value of benefits built up before 1 April 2014 in the final salary scheme will buy an amount of earned pension in the career average scheme which will be added into your new active pension account.

When will my benefits be payable?

If you choose this option then your combined benefits will be payable at your Normal Pension Age under the career average scheme which will be the same as your State Pension Age (with a minimum age 65). For more information on Normal Pension Age see the Re-joiner Glossary.

Rule of 85

If you choose option one, any rule of 85 protection you previously had will be reflected in the amount of earned pension bought. Therefore, to reflect the fact that those earlier benefits would now be payable unreduced at your Normal Pension Age under the career average scheme (i.e. the same as your State Pension Age, with a minimum age of 65) the amount or earned pension bought by the transferred benefits would be higher because you previously had rule of 85 protection.

In addition, if your previous benefits are combined with your new employment under option one, there are further protections for rule of 85 if you are close to retirement including:

-

If you will be age 60 or over by 31 March 2016 and re-join the scheme before 1 April 2016 then the rule of 85 will continue to apply to the membership you build up between re-joining the scheme and 31 March 2016 (although the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85). However, the rule of 85 will not continue to apply to the amount of earned pension bought when you combined your deferred pension (but the amount of earned pension bought will include an amount to compensate for the loss of rule of 85 protection on that pension).

-

If you will be age 60 between 1 April 2016 and 31 March 2020 and re-join the scheme before 1 April 2020 then the rule of 85 will continue to apply to the membership you build up between re-joining the scheme and 31 March 2020 (although the date you meet the rule of 85 may move closer to your Normal Pension Age because the break in service between your previous period of membership and your new period of membership will not count towards the rule of 85). However, the rule of 85 will not continue to apply to the amount of earned pension bought when you combined your deferred pension (but the amount of earned pension bought will include an amount to compensate for the loss of rule of 85 protection on that pension).

Please note: If you have more than one active pension account (because you have more than one current employment in which you are contributing to the LGPS) you will need to decide which active pension account you wish the benefits from your deferred refund to be combined with.

If you choose option one then you must make that election within 12 months of rejoining the scheme and whilst you are still paying into the scheme.

Option Two

You can elect to keep your deferred benefit separate from your new active pension account.

If you decide not to combine your deferred benefits or you do not make an election within 12 months of re-joining the scheme then your deferred benefits will remain separate.

How will the benefits from my previous employment be worked out?

If you choose option two your deferred benefit will remain as previously calculated and held with your previous Pension Fund (if not the West Midlands Pension Fund). See Working out your benefits in the LGPS the Re-joiner Glossary for information on how these benefits are calculated.

The deferred benefit will increase each year in line with inflation, as currently measured by the rise in the Consumer Prices Index.

When will my deferred benefits be payable?

The date your deferred benefits are payable would remain the same, with your Normal Pension Age being age 65 if the deferred benefits relate to a period of membership that ended after 30 September 2006, or a date somewhere between 60 and 65 if the deferred benefits relate to a period of membership that ended before 1 October 2006. For more information on Normal Pension Age see the Re-joiner Glossary.

Rule of 85

If you chose option two (i.e. decide not to combine your previous benefits with your new active pension account) and you have rule of 85 protections, then these continue to apply to your deferred benefits only.

For more information on the rule of 85 see the Re-joiner Glossary.

|

What key differences are there if I elected to keep my deferred benefits separate? |

||

|

|

Combined Benefits |

Separate Benefits |

|

Redundancy/ Business Efficiency |

Benefits paid early because of redundancy or efficiency would include the value of earlier deferred benefits that have been transferred. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately and would include the value of the pension that transferred from your deferred benefit. |

Benefits paid early because of redundancy or efficiency in your new employment would not include the value of earlier deferred benefits. If you are made redundant or lose your job for business efficiency reasons when aged 55 or over then your benefits would be payable immediately but would not include the value of your deferred benefit (because you had elected to retain that as a separate deferred benefit). Subject to the information in the boxes below, the separate deferred benefits would be payable at your Normal Pension Age. |

|

Ill- health |

Any benefits paid early because of ill-health would include value of earlier deferred benefits that have transferred. Your benefits will become payable immediately if your employer decides, based on the opinion of an independent doctor that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would include the value of your pension that transferred from your deferred benefit. |

Benefits paid early because of ill-health would not include the value of earlier deferred benefits. Your benefits from your new employment will become payable immediately if your employer decides, based on the opinion of an independent doctor, that you are permanently unable to perform the duties of your employment due to ill-health and you are not capable of undertaking other gainful employment. Your pension would be paid at an increased level if you are unlikely to be capable of undertaking other gainful employment within 3 years of leaving. The payment would not include the value of your deferred benefit (because you elected to retain that as a separate deferred benefit). Your separate deferred benefit may become payable but that would only be if your former employer decided in light of the view from an independent doctor that you are permanently incapable of the job you were working in when you left the employment in respect of which the deferred benefit was awarded and, if the deferred benefits arose as a result of ceasing membership of the scheme after 31 March 2008, that you are not likely to be capable of undertaking other gainful employment before your Normal Pension Age or for at least 3 years, whichever is the sooner. |

|

Early payment of benefits |

You can voluntarily choose to draw the combined benefits from as early as age 55 (at, normally, a reduced rate to account for the early payment). However, the combined benefits would be payable at the same time (i.e. cannot be paid at different times) and cannot be paid until you have ceased your new employment.

|

You can voluntarily choose to draw: a) your deferred benefit from as early as age 60 or, with your former employer's consent, from as early as age 50 if the deferred benefits arose as a result of ceasing membership of the scheme after 31 March 1998 and before 1 April 2008, or age 55 if the deferred benefits arose as a result of ceasing membership of the scheme after 31 March 2008 (at, normally, a reduced rate to account for the early payment) and b) the pension you build up in your pension account in your new employment from as early as age 55 (at, normally, a reduced rate to account for the early payment). The deferred benefits do not have to be drawn at the same time as the benefits from your new employment. The deferred benefits can be drawn later than, at the same time as or, subject to being the minimum age shown in (a) above and, where necessary, obtaining your former employer's permission, earlier than the benefits from your new employment (even if you are still in your new employment at the time you wish to draw the deferred benefits, provided the deferred benefits relate to a period of membership that ended after 31 March 1998). However, if the deferred benefits relate to a period of membership that ended before 1 April 1998, the earliest you can voluntarily draw the deferred benefits is:

(i) the date you cease such employment, or (ii) your Normal Pension Age in relation to those deferred benefits (see the Re-joiner Glossary). |

|

Cost of living increases |

If you choose option 1, the combined benefits in respect of your post 31 March 2014 membership will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see the Re-joiner Glossary for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative.

|

The benefits in the active pension account for your new employment will be subject to revaluation each year in accordance with HM Treasury Orders. The revaluation is currently in line with the rise in the Consumer Prices Index (see the Re-joiner Glossary. for more information). However, in times of negative inflation, the revaluation under a HM Treasury Order could be negative. The benefits in the deferred pension account will be subject to revaluation each year under the Pensions (Increase) Act 1971. Future revaluation is currently in line with the rise in the Consumer Prices Index (see glossary for more information). In times of negative inflation, the revaluation under the Pensions (Increase) Act 1971 would be 0% (i.e. it cannot be a negative amount). |

Death in Service lump sum

As a member of the LGPS if you die in service a lump sum of three times your annual pensionable pay would normally be payable. If you have a deferred pension and die before it is paid, a lump sum equal to five times the deferred pension is paid if the deferred benefits relate to a period of membership that ended after 31 March 2008, or a lump sum equal to three times the deferred pension is paid if the deferred benefits relate to a period of membership that ended before 1 April 2008. However, only one amount for lump sum life cover is payable from the LGPS so, even if you keep your deferred benefits separate from your active pension account only the greater of the lump sum life cover for your deferred benefit or for your active pension account would be payable.

Annual Allowance Potential Tax Implications

You are advised to be aware of any potential tax implications around combining your deferred benefits under option one and option two with your new active pension account. In the unlikely event that a tax charge would apply the West Midlands Pension Fund would make you aware of the implications. Please see the Re-joiner Glossary for more information on annual allowance.

Paying extra contributions

Have you paid extra contributions towards buying additional pension or membership? These would include Additional Voluntary Contributions (AVCs), Added Years or Additional Regular Contributions (ARCs). Please read paying extra contributions in the Re-joiner Glossary to find out what your choices in respect of these are.

Transferring the value of your deferred benefit to another pension scheme

Please note that even if you choose not to combine your benefits you will not be able to transfer the value of your deferred benefits to another pension scheme whilst you are contributing to the LGPS or if you have less than one year to go before reaching your Normal Pension Age.

What next?

Please complete the attached option form we've provided you to tell us whether or not you wish to combine your benefits and, if you do, whether you wish to elect for option one. This will enable us to take the appropriate action in respect of your pension rights as quickly as possible. If we do not receive your completed form within 12 months of the date you re-joined the scheme, your previous deferred benefit will remain separate and/or held in your previous Pension Fund (where applicable).

Once you have chosen which option you wish to proceed with you cannot change your decision. If you do not elect for option one then your deferred benefit will remain separate from your new active pension account.

This scenario applies when you have left an employment after 31 March 2014 with an entitlement to a deferred refund which is based on post-31 March 2014 membership (or on membership which is treated as post-31 March 2014 membership) only and you continue to be an active member in an ongoing employment.

As you are continuing in the LGPS in your other employment(s), you are not eligible to take a refund of the contributions in your deferred refund account, and so the amount of pension in your deferred refund account will automatically be transferred and added into your ongoing active account.